In today’s business world, handling invoices can be challenging. Many small and large businesses still rely on manual invoicing methods, which are time-consuming and prone to errors. But, accounting software is a tool that can make invoicing easier. It helps businesses streamline their invoicing processes, reduce mistakes, and save time.

What is Accounting Software?

Accounting software is a digital tool that helps businesses manage financial tasks. This includes invoicing, bookkeeping, payroll, and other financial management functions. With the rise of cloud-based software, businesses can now access accounting tools from anywhere, at any time.

The primary benefit of accounting software is that it simplifies accounting tasks. In particular, invoicing, which can otherwise be a complex and error-prone process, becomes much easier.

How Does Accounting Software Simplify Invoicing?

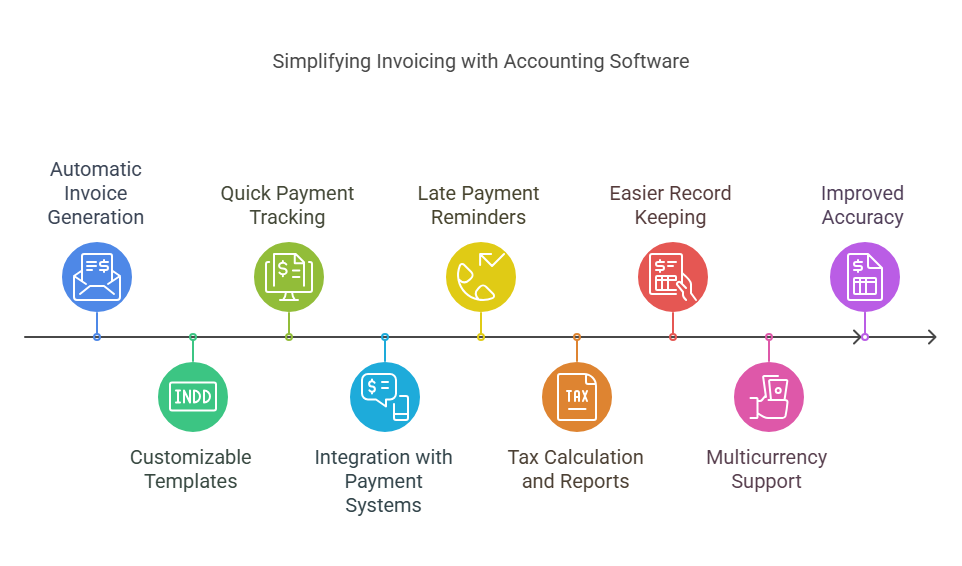

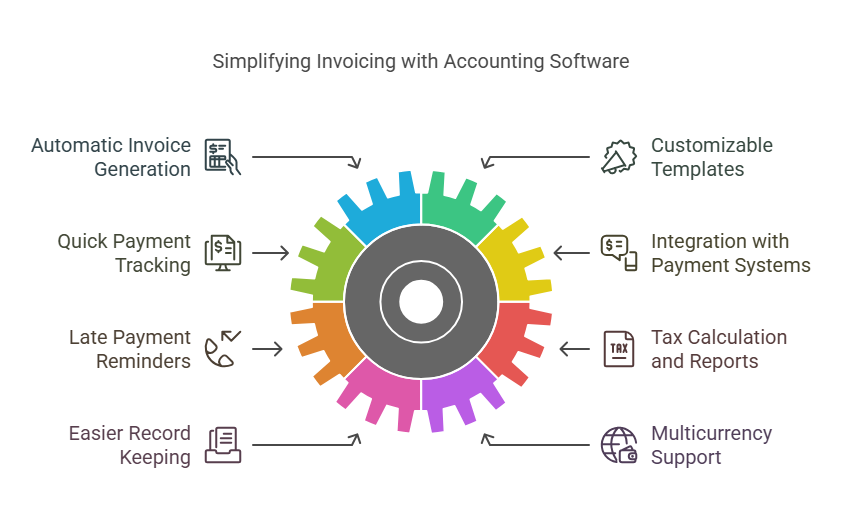

Here’s a breakdown of how accounting software simplifies the invoicing process:

1. Automatic Invoice Generation

One of the biggest advantages of using accounting software is that it automates invoice generation. Instead of creating invoices manually, the software can generate invoices automatically. This saves time and ensures that invoices are consistent and accurate.

Once you input customer details and services or products, the software can create a fully detailed invoice. It includes the customer’s name, address, payment terms, due date, and a list of the products or services provided.

2. Customizable Templates

Most accounting software offers customizable templates. This means you can create professional-looking invoices that match your brand’s style. You can include your company logo, select different font styles, and personalize the format to suit your needs.

Customizable templates also save time. You do not need to create a new layout for every invoice you issue. Simply use the template, and the software will fill in the necessary details.

3. Quick Payment Tracking

Another important benefit of accounting software is its ability to track payments. When a customer makes a payment, the software automatically updates your records. You can quickly see which invoices have been paid and which are still pending.

This eliminates the need for manual tracking. No more paper records or spreadsheets to update. Everything is stored digitally, which helps keep your financial data organized.

4. Integration with Payment Systems

Most accounting software integrates with online payment systems like PayPal, Stripe, or bank accounts. This makes it easy for clients to pay their invoices directly through the invoice itself.

When customers make payments, the system automatically updates your records and reflects the payment. This reduces the risk of errors and late payments.

5. Late Payment Reminders

Late payments can be a major issue for businesses. But, accounting software can help solve this problem by sending automatic reminders to customers. These reminders can be set to go out when an invoice is overdue.

Instead of manually reminding customers about late payments, the software does it for you. This reduces stress and helps you get paid on time.

6. Tax Calculation and Reports

Calculating taxes can be confusing. But accounting software makes it easy. It automatically calculates tax for each invoice based on your tax settings. This ensures that your invoices are compliant with local tax laws.

Moreover, the software can generate reports that show how much tax has been collected over a specific period. These reports are helpful when preparing for tax season.

7. Easier Record Keeping

Manual invoicing often results in piles of paper records. Accounting software eliminates the need for paper invoices. All your invoices are stored digitally, making them easy to access and manage.

You can search for specific invoices, filter by date, and even export the data for accounting purposes. This digital storage saves space and reduces the risk of losing important documents.

8. Multicurrency Support

If you do business internationally, you may need to issue invoices in different currencies. Most accounting software supports multiple currencies. This makes invoicing easier for international transactions.

source: Multicurrency SupportThe software will automatically calculate the exchange rate and generate invoices in the correct currency, saving you time and ensuring accuracy.

9. Improved Accuracy

Human error is a common problem with manual invoicing. With accounting software, the chances of making mistakes are significantly reduced. The software automatically fills in details like prices, taxes, and total amounts. This minimizes the risk of errors and ensures that your invoices are accurate.

10. Invoice History and Reports

Many accounting software programs provide detailed reports on your invoicing history. These reports give you insights into your revenue, outstanding invoices, and payment trends.

Having access to this data allows you to make informed decisions about your business. It helps you identify patterns, such as which clients pay on time and which tend to delay payments.

Why is Simplifying Invoicing Important?

Invoicing is a critical part of any business. It ensures that you get paid for your goods or services. However, managing invoices manually can take up a lot of time and energy. This is where accounting software comes in.

Simplifying the invoicing process allows you to focus more on growing your business. It eliminates the repetitive and error-prone tasks, leaving you with more time to focus on other important business activities.

Using accounting software also ensures that your invoices are professional. This can build trust with clients and improve your business image. Accurate invoices that are easy to understand can help avoid misunderstandings and payment delays.

FAQ About Accounting Software and Invoicing

1. What is the best accounting software for invoicing?

There are many great options available, such as QuickBooks, FreshBooks, and Xero. The best software depends on your business needs and budget.

2. Can I create custom invoices with accounting software?

Yes, most accounting software offers customizable invoice templates. You can add your logo, change the layout, and adjust the design to match your business style.

3. How does accounting software track payments?

Accounting software tracks payments by automatically updating your records when a payment is made. It can also integrate with payment systems like PayPal or Stripe for seamless tracking.

4. Does accounting software calculate taxes automatically?

Yes, most accounting software can automatically calculate taxes for each invoice based on your tax settings. It ensures that you are always compliant with local tax laws.

5. Is accounting software secure for storing invoices?

Yes, accounting software uses encryption and secure servers to store your invoices. It is much safer than keeping paper invoices or using unprotected digital files.

Final Thoughts

Accounting software makes invoicing easier, faster, and more accurate. By automating the process, reducing errors, and offering features like customizable templates and payment tracking, it saves businesses valuable time and effort.

If you’re still using manual methods, switching to accounting software is a smart decision. It not only simplifies invoicing but also helps with overall business management, allowing you to focus on what truly matters—growing your business.

For small businesses, using accounting software can lead to greater efficiency, fewer mistakes, and improved customer relationships. If you haven’t already, it might be time to consider making the switch.