Managing finances is one of the biggest challenges for small businesses. Accounting software plays a crucial role in streamlining financial processes, reducing errors, and enhancing efficiency. It helps businesses track expenses, manage cash flow, and stay compliant with tax regulations. Let’s explore how accounting software impacts small business growth.

What is Accounting Software?

Accounting software is a digital tool that helps businesses automate financial tasks. It records transactions, tracks income and expenses, generates reports, and simplifies tax preparation. This allows businesses to maintain accurate financial records without relying solely on manual bookkeeping.

Why Small Businesses Need Accounting Software

Small businesses often struggle with financial management. Manual bookkeeping is time-consuming and prone to errors. Accounting software automates complex processes, providing efficiency and accuracy. 64% of small businesses use accounting software for financial management. 82% of businesses fail due to cash flow problems. Proper financial management can prevent this.

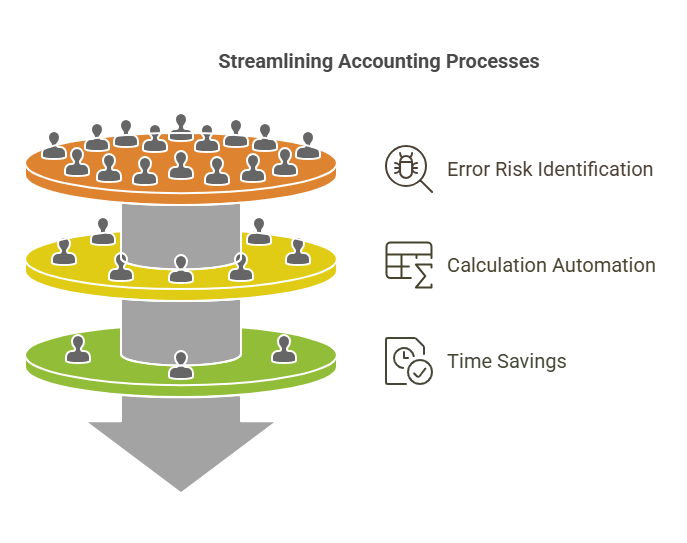

1. Saves Time and Reduces Errors

Manual data entry increases the risk of errors. A small miscalculation can cause financial discrepancies. Accounting software automates calculations, reducing human errors and saving valuable time.

2. Real-Time Financial Tracking

Business owners need up-to-date financial information to make informed decisions. Accounting software provides real-time tracking of income, expenses, and profit margins.

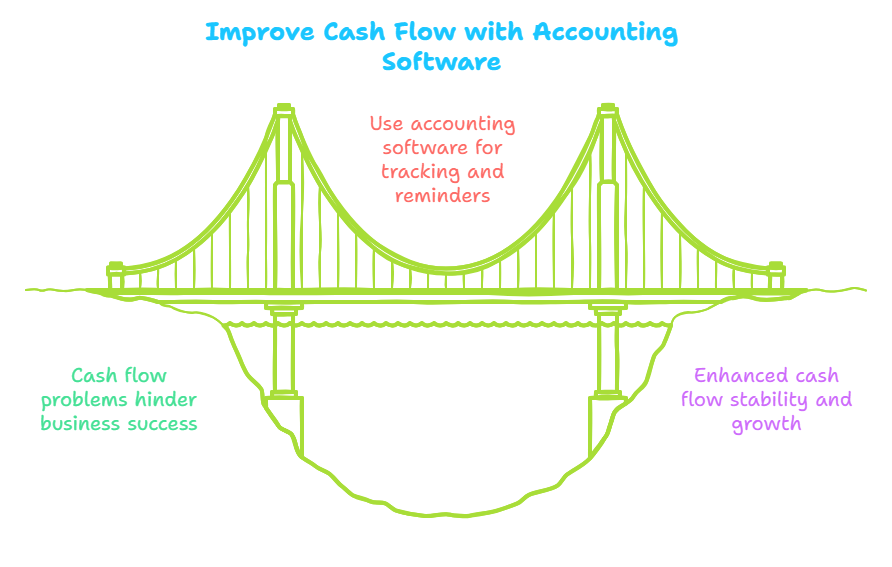

3. Better Cash Flow Management

Cash flow problems are a major cause of business failure. Accounting software helps track receivables, send payment reminders, and ensure timely cash flow management.

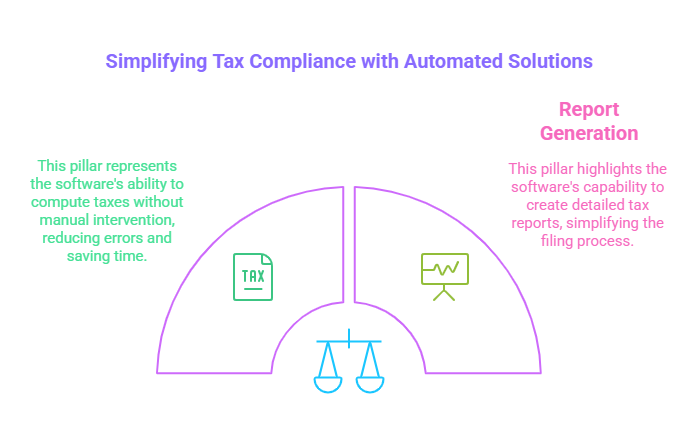

4. Tax Compliance Made Easy

Tax regulations can be complicated. Accounting software calculates taxes automatically and generates reports, simplifying tax filing.

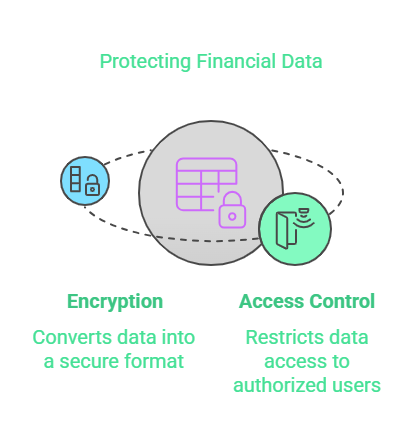

5. Secure Financial Data

Financial data is sensitive and must be protected. Accounting software offers encryption and access control features to prevent unauthorized access.

6. Scalability for Business Growth

As a business grows, financial transactions increase. Accounting software scales with the business, handling more transactions and generating detailed financial insights.

Key Features of Accounting Software

Modern accounting software includes essential features to help businesses stay organized.

1. Automated Bookkeeping

Automatically records transactions, reducing the need for manual data entry.

2. Invoice Management

Creates, sends, and tracks invoices, ensuring businesses get paid on time.

3. Expense Tracking

Categorizes and monitors expenses, helping businesses control spending.

4. Bank Reconciliation

Matches bank transactions with financial records to ensure accuracy.

5. Tax Calculation and Reporting

Generates tax reports and helps businesses stay compliant with tax regulations.

6. Multi-User Access

Allows accountants and employees to access financial data securely.

How Accounting Software Boosts Profitability

Accounting software improves financial management, leading to increased profitability.

1. Reduces Operational Costs

Automating financial tasks minimizes the need for additional staff, reducing labor costs.

2. Prevents Financial Mistakes

Mistakes in financial records can be costly. Accounting software ensures accuracy and prevents financial losses.

3. Supports Budgeting and Forecasting

Businesses can analyze past expenses and create accurate financial forecasts for better planning.

4. Increases Productivity

Employees spend less time on bookkeeping and more time on revenue-generating tasks.

Choosing the Right Accounting Software

Selecting the best accounting software depends on business needs and budget.

1. Business Size and Requirements

Small businesses need basic accounting software, while larger businesses require advanced tools.

2. User-Friendly Interface

Software should be easy to use to avoid a steep learning curve.

3. Integration with Other Tools

Accounting software should integrate with inventory, payroll, and CRM tools.

4. Cloud-Based vs. Desktop Software

Cloud-based solutions offer remote access, while desktop software works offline.

5. Security and Customer Support

Strong security features protect financial data. Reliable customer support ensures smooth operation.

Expert Insights on Small Business Accounting

According to QuickBooks, businesses using accounting software experience a 75% reduction in financial errors. (Source)

Frequently Asked Questions (FAQs)

1. What is the best accounting software for small businesses?

Popular options include QuickBooks, Xero, and FreshBooks. The best choice depends on business needs.

2. Can accounting software replace an accountant?

No, but it simplifies financial tasks. Accountants provide strategic insights.

3. Is cloud-based accounting software secure?

Yes, reputable cloud-based software offers encryption and backup features.

4. How much does accounting software cost?

Pricing varies. Some platforms offer free plans, while others charge between $10 to $50 per month.

5. Do all small businesses need accounting software?

Most small businesses benefit from accounting software, especially as they grow