Managing finances is critical for the success of any small business. Small

business owners often juggle many tasks, and accounting can easily

become overwhelming. Using accounting software is one of the best ways to

simplify financial management. It helps you track expenses, send invoices,

and keep your business running smoothly. This article explores the top

features of accounting software for small businesses and why they are

essential.

Why Do Small Businesses Need Accounting Software?

Small business owners typically do not have formal training in accounting.

Despite this, they must still manage finances, track income, and pay taxes.

Manual bookkeeping can be time-consuming, complex, and prone to errors.

That’s where accounting software steps in. It simplifies these processes and

ensures your finances are organized and accurate.

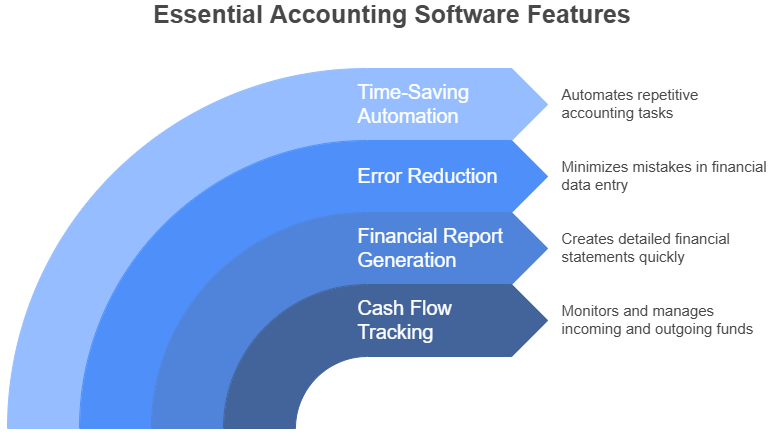

Accounting software helps you save time and reduce mistakes. It also

provides insights into your financial health, which is essential for making

good business decisions. Moreover, the software allows you to focus on

growing your business rather than managing piles of paperwork.

In the next sections, we’ll look at the top features that make accounting

software a must-have for small businesses.

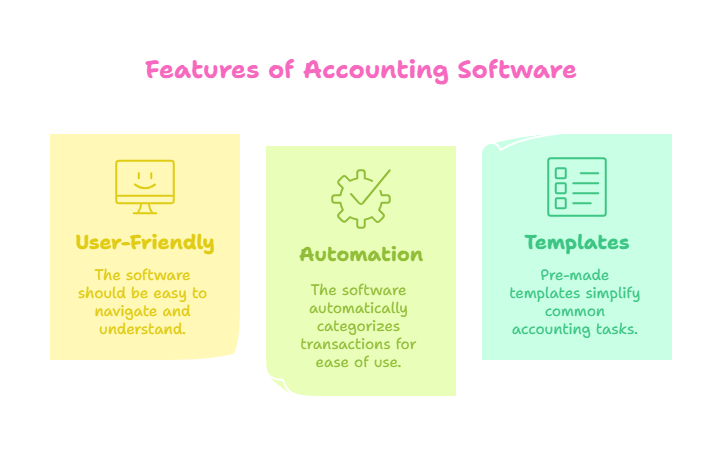

1. Ease of Use

One of the most important features of accounting software is ease of use.

Small business owners often do not have accounting expertise. Therefore,

the software must be user-friendly. It should have an intuitive interface with

clear instructions.

Good accounting software allows you to enter data without much effort. For

example, software like QuickBooks and Xero automatically categorizes your

transactions. You don’t need to spend time figuring out how everything

works. This helps you get started quickly.

Many software tools come with templates for common tasks like invoicing

or expense tracking. These templates can make the whole process even

easier.

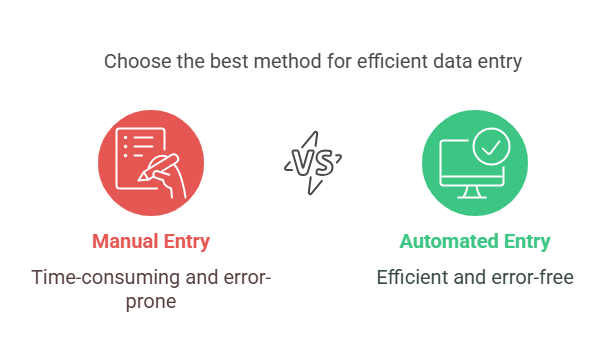

2. Automated Data Entry

Data entry can be a tedious and error-prone task. Manual entry is also

time-consuming, especially when dealing with hundreds of transactions.

Accounting software helps solve this problem by automating the process.

Most accounting software can integrate with your bank and credit card

accounts. This feature automatically imports transactions into the software.

It also categorizes them correctly, saving you from entering each transaction

manually. For example, QuickBooks and Xero offer automatic bank feeds

that update your records in real-time.

This feature ensures that your financial data is always up-to-date. It reduces

the chance of human errors and makes data entry much quicker.

3. Expense Tracking

Tracking expenses is crucial for any small business. Keeping an eye on

where your money goes helps you control your budget and improve your

cash flow. Accounting software makes it easier to track expenses by

categorizing them automatically.

With the right software, you can set up categories for different types of

expenses, such as office supplies, travel, and salaries. The software will then

track every purchase made in these categories. Some programs, like

FreshBooks, also allow you to upload receipts directly into the system. This

ensures that all expenses are recorded properly.

Having an accurate record of your expenses is essential for tax purposes. It

can help you claim deductions and avoid overpaying on taxes.

4. Invoicing and Billing

Small businesses rely on invoicing to get paid for their services. Accounting

software makes creating and sending invoices fast and easy. With features

like customizable templates, you can send professional invoices that reflect

your brand.

Most accounting software also allows you to track payments. If an invoice is

overdue, the software can send automated reminders to customers. This

feature ensures that you follow up on late payments without having to worry

about forgetting.

QuickBooks, for example, allows users to set up recurring invoices for

customers who make regular payments. This automation reduces the time

spent on manual billing.

5. Financial Reporting

Accurate financial reporting is essential for understanding your business’s

performance. With accounting software, you can generate detailed financial

reports at the click of a button. These reports give you a clear picture of

where your business stands financially.

Common reports include:

● Profit and loss statement

● Balance sheet

● Cash flow statement

By regularly reviewing these reports, you can monitor trends in revenue and

expenses. This information helps you make better financial decisions.

Accounting software also allows you to customize reports. For example,

Xero lets you create reports that break down your income and expenses by

category, providing deeper insights.

6. Tax Calculation and Filing

Tax season can be stressful for small business owners. Accounting software

helps reduce that stress by calculating your taxes based on your financial

records. Many programs automatically track sales tax and income tax,

making tax preparation much easier.

Some software solutions also allow you to file taxes directly through the

platform. For instance, QuickBooks allows you to file sales tax returns online.

This feature reduces the chances of errors and ensures that your taxes are

filed on time.

Having a clear record of your taxes helps you avoid audits and penalties. It

also ensures that you don’t miss out on any tax deductions.

7. Inventory Management

For businesses that sell physical products, managing inventory is crucial.

Accounting software often includes inventory management tools. These

tools track the number of products you have in stock and update

automatically as you make sales or purchases.

By using inventory management features, you can prevent overstocking or

running out of stock. For example, FreshBooks has an inventory tracking

feature that helps you monitor stock levels and reorder items when

necessary.

Inventory management tools can also integrate with your accounting

records, ensuring that all sales and purchases are automatically reflected in

your financial reports.

8. Multi-Device Access

In today’s fast-paced world, small business owners need access to their

financial data from anywhere. Cloud-based accounting software provides

this flexibility. You can log in from your computer, tablet, or smartphone to

manage your finances on the go.

Software like Xero and QuickBooks offers mobile apps, making it easy to

manage your business finances from anywhere. Whether you’re in the office

or traveling, you can keep track of expenses, send invoices, and view

financial reports on the go.

Having access to your financial data anytime, anywhere, is especially useful

for small business owners who are always on the move.

9. Security

Security is a top priority when dealing with financial data. Accounting

software uses encryption and other security measures to protect your

information. Cloud-based accounting software typically has regular backups

and security updates to ensure your data stays safe.

For example, QuickBooks and Xero are both known for their strong security

features. They use data encryption, multi-factor authentication, and secure

cloud storage to protect your financial records.

Security features help prevent unauthorized access to your data and reduce

the risk of fraud. This peace of mind is essential for small business owners

who rely on their financial data to make decisions.

10. Scalability

As your business grows, so do your accounting needs. Good accounting

software should be scalable, meaning it can grow with your business. Many

software platforms offer flexible plans that allow you to upgrade as your

business expands.

Scalable accounting software provides the ability to add new features or

integrate with other tools. For instance, as your business grows, you may

need more advanced reporting features, payroll management, or inventory

tracking. A scalable platform allows you to add these features without

needing to switch to a new software.

Choosing software that can scale ensures that you can continue using the

same platform as your business grows.

11. Customer Support

Good customer support is essential when using accounting software. If you

encounter problems or have questions, responsive customer service can

help resolve issues quickly. Many software providers offer 24/7 customer

support through phone, email, or live chat.

Most accounting software platforms also have extensive help centers with

tutorials, FAQs, and guides. These resources help users understand the

software’s features and troubleshoot common issues.

For example, QuickBooks offers a variety of support options, including live

chat and a large help center with articles and videos.

12. Affordable Pricing

Pricing is a significant factor for small businesses. Accounting software

should offer an affordable solution that fits your budget. Many platforms

offer different pricing plans based on the features you need. You can start

with basic plans and upgrade as your business grows.

Software like Wave offers free accounting tools for small businesses, while

other platforms like FreshBooks and QuickBooks offer reasonably priced

plans that fit various budgets.

Affordable pricing ensures that even small businesses with limited funds can

access the tools they need to manage their finances effectively.

Benefits of Using Accounting Software for Small Business

Accounting software offers several key benefits for small businesses,

including:

● Time-saving: Automates routine tasks like data entry and invoicing.

● Accuracy: Reduces human errors and ensures accurate financial records.

● Better decision-making: Provides financial insights through detailed reports.

● Improved cash flow: Helps manage invoices and track payments.

● Tax readiness: Makes tax preparation and filing easier and more accurate.

FAQs

- What is the best accounting software for small businesses? The best accounting

software depends on your needs. QuickBooks, Xero, and FreshBooks are popular

choices. - How much does accounting software cost? Prices vary. Basic plans range from

$10 to $30 per month. Advanced plans can cost $50 or more. - Can I use accounting software to file taxes? Yes, many accounting software

platforms offer tax filing features. - Can accounting software track my expenses automatically? Yes, most

accounting software automatically categorizes and tracks expenses. - Is accounting software secure? Yes, reputable accounting software uses

encryption and other security measures to protect your data.

Conclusion

Accounting software is a must-have tool for small businesses. It simplifies

financial management, reduces errors, and saves time. With features like

automated data entry, invoicing, and tax calculation, accounting software

helps small business owners stay organised and make better decisions.

Whether you’re just starting or looking for ways to streamline your

operations, accounting software can help you take control of your finances

and grow your business