Managing business finances is essential for success. Small business owners need accounting software that is simple and effective. The right software saves time and reduces financial errors. This guide explores the best accounting software options that are easy to use and beneficial for small businesses.

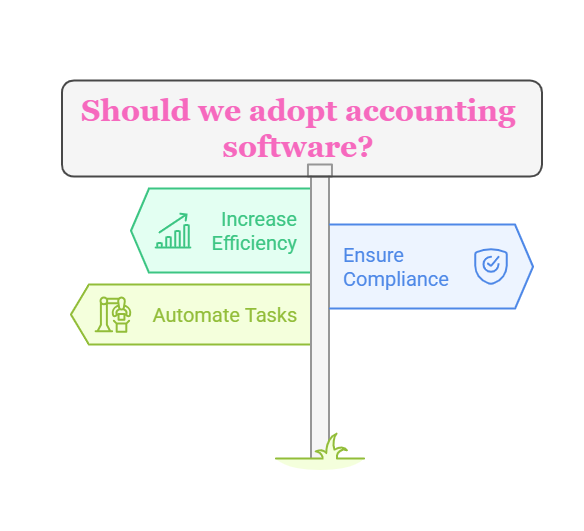

Why Small Businesses Need Accounting Software

Many small businesses struggle with bookkeeping. Manual accounting takes time and increases mistakes. A good accounting tool automates tasks and provides real-time financial insights. It also ensures compliance with tax regulations.

- 67% of small businesses rely on accounting software to manage their finances.

- 82% of businesses that use accounting software report increased efficiency.

Best Easy-to-Use Accounting Software for Small Businesses

Best Easy-to-Use Accounting Software for Small Businesses

Here are some top choices for accounting software that are simple and effective.

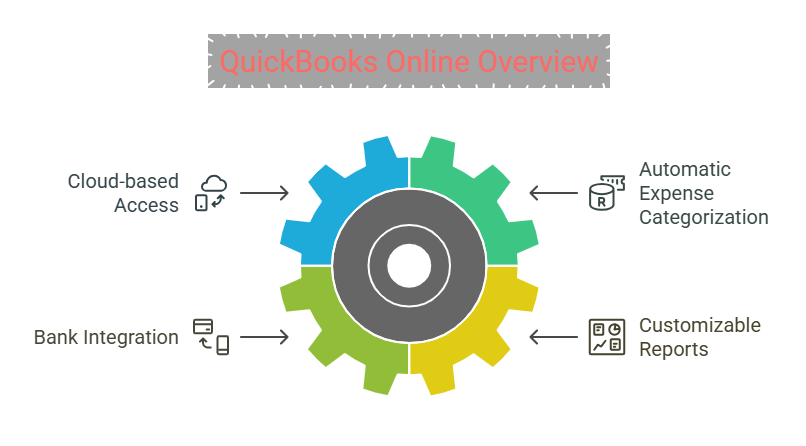

1. QuickBooks Online

Best for: Small businesses needing a complete accounting solution.

QuickBooks Online is one of the most popular accounting software options. It offers features like invoicing, expense tracking, and tax preparation.

Key Features:

- Cloud-based access from any device.

- Automatic expense categorization.

- Integration with banks and payment platforms.

- Customizable reports for financial analysis.

Pricing: Paid services available

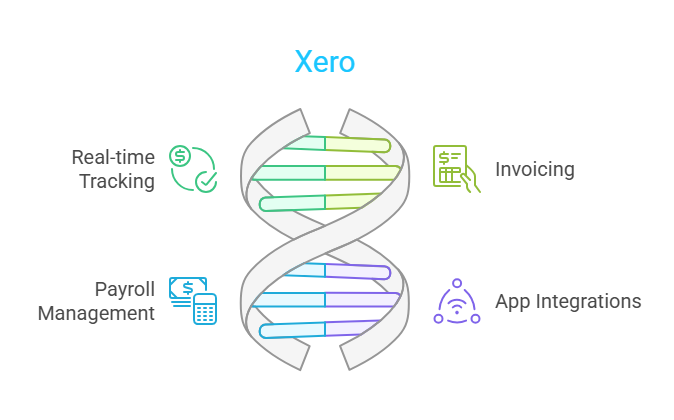

2. Xero

Best for: Businesses that need multi-user access and third-party integrations.

Xero is a cloud-based accounting tool with a simple interface. It supports unlimited users and offers strong integration capabilities.

Key Features:

- Real-time cash flow tracking.

- Online invoicing with automatic reminders.

- Payroll and tax management.

- Integrations with over 800 apps.

Pricing: Paid services available

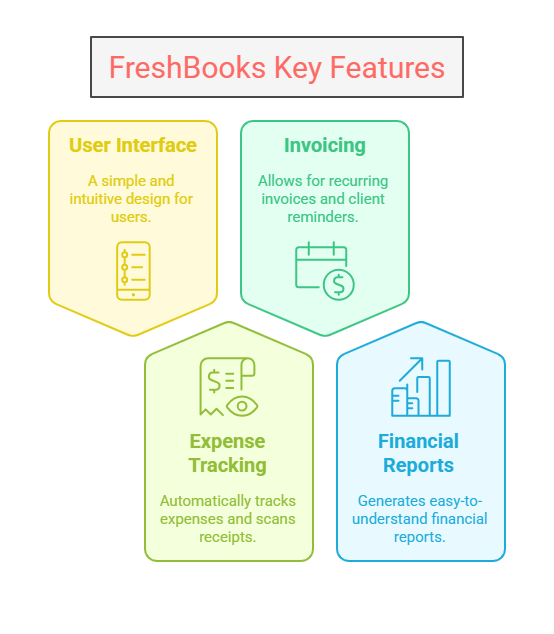

3. FreshBooks

Best for: Service-based businesses and freelancers.

FreshBooks is designed for simplicity and ease of use. It helps businesses manage invoices, expenses, and time tracking.

Key Features:

- User-friendly interface with a mobile app.

- Automatic expense tracking and receipt scanning.

- Recurring invoices and client reminders.

- Easy-to-generate financial reports.

Pricing: Paid services available.

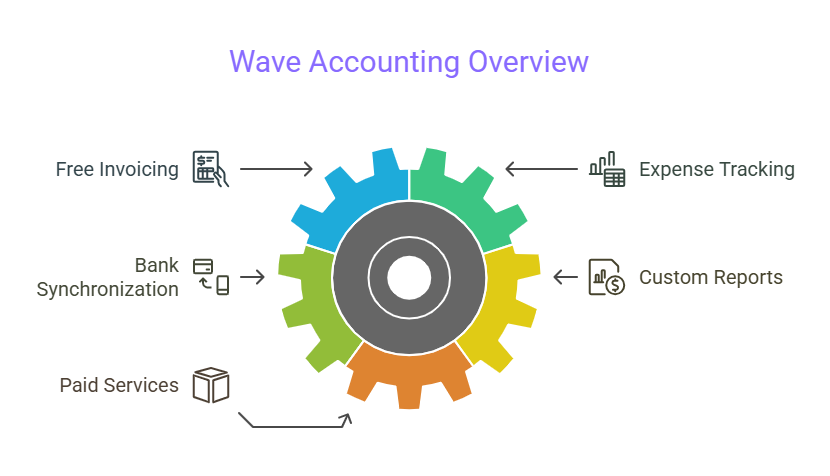

4. Wave

Best for: Businesses looking for a free accounting solution.

Wave is a free accounting software option for small businesses. It offers essential features for bookkeeping and invoicing.

Key Features:

- Free invoicing and expense tracking.

- Bank account synchronization.

- Customizable financial reports.

- Pay-per-use payroll and payment processing.

Pricing: Paid services available.

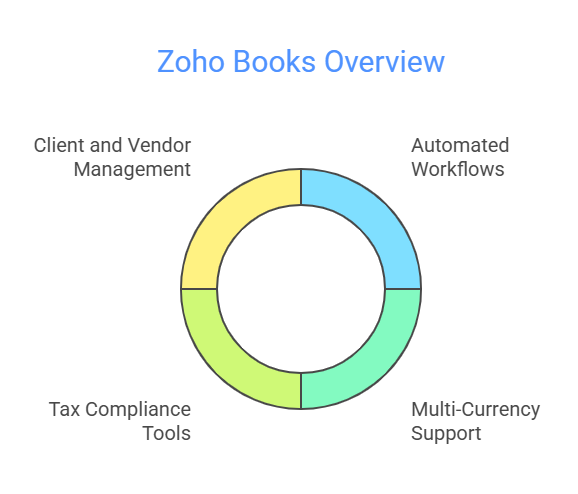

5. Zoho Books

Best for: Businesses needing automation and affordability.

Zoho Books provides a robust accounting platform with automation features.

Key Features:

- Automated workflows for bookkeeping.

- Multi-currency support for global transactions.

- Tax compliance and reporting tools.

- Client and vendor management.

Features to Look for in Accounting Software

Choosing the right software depends on your business needs. Here are some key features to consider:

1. Ease of Use

The software should have a simple interface and be easy to navigate.

2. Automation

Look for automation in invoicing, expense tracking, and tax calculations.

3. Scalability

Choose software that can grow with your business.

4. Integration

Ensure compatibility with payment platforms, banks, and other business tools.

5. Security

Financial data security is crucial. Opt for software with encryption and secure backups

FAQs

1. What is the easiest accounting software for beginners?

QuickBooks Online and Wave are beginner-friendly options with simple interfaces.

2. Can I use free accounting software for my business?

Yes, Wave and Akaunting offer free accounting tools with essential features.

3. Do I need accounting software if I have a small business?

Yes, it helps you track income, expenses, and taxes more efficiently.

4. Is cloud-based accounting software secure?

Most cloud-based solutions use encryption and security measures to protect data.

5. Which accounting software integrates with PayPal and Stripe?

QuickBooks, Xero, and FreshBooks offer seamless integration with these payment platforms.

Conclusion

Choosing the right accounting software makes financial management easier for small businesses. Consider features, pricing, and ease of use when selecting the best option for your needs. Whether you choose QuickBooks, Xero, or a free tool like Wave, having an accounting system in place will benefit your business in the long run.