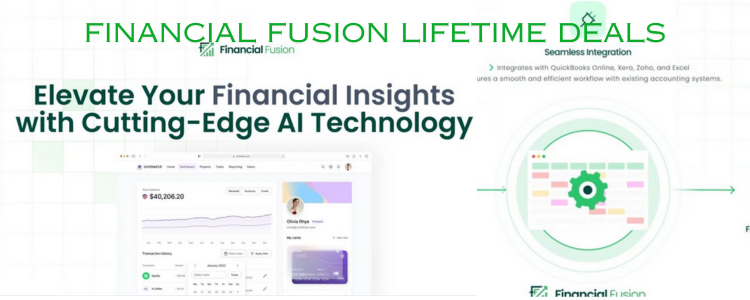

Financial Fusion Accounting Software Review: The Ultimate Guide to Choosing the Right Tool for Your Business

Financial Fusion Accounting Software is a comprehensive solution for businesses of all sizes, designed to simplify the complexities of financial management. Whether you’re a small startup or a growing enterprise, this software offers tools to help you manage everything from bookkeeping to payroll, tax filing, and financial reporting. Key Features of Financial Fusion Accounting Software … Read more