Accounting is an essential function for every business. However, traditional accounting processes often involve a lot of time, effort, and human intervention. From tracking expenses to handling invoices, accounting tasks can be a headache when done manually. Fortunately, advancements in technology have led to the development of accounting automation software that simplifies these tasks.

In this post, we will discuss the key benefits of accounting automation software and how it can help businesses save time, reduce errors, and improve financial accuracy.

What is Accounting Automation?

Accounting automation refers to the use of software to handle tasks that were traditionally done manually. The goal of accounting automation is to replace repetitive and time-consuming manual processes with efficient AI-powered tools. These tools can process large volumes of data quickly, automate routine tasks, and generate reports without human involvement.

Accounting automation eliminates the need for manual data entry, which can result in errors. It also ensures that businesses can comply with regulatory requirements and manage their finances more effectively.

How Does Accounting Automation Work?

Accounting automation software works by automating routine accounting tasks such as invoicing, data entry, expense management, and financial reporting.

The process starts when data is entered into the software. This can be done manually or automatically through tools like Optical Character Recognition (OCR), which scans invoices and receipts to extract relevant information. Once the data is extracted, it is automatically categorized and stored in the system.

The software then generates reports, updates ledgers, and performs reconciliations. All of this is done automatically, ensuring that your financial records are up-to-date and accurate.

Advantages of Accounting Automation Software

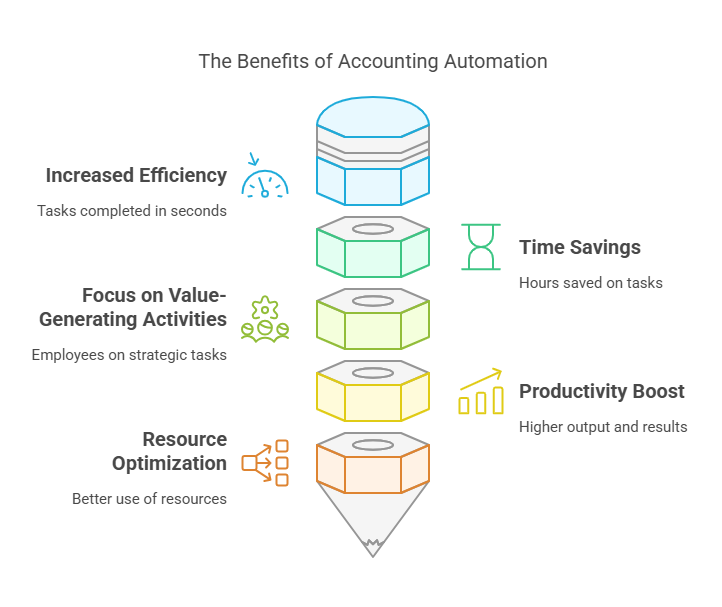

1. Increased Efficiency

One of the most significant advantages of accounting automation is the increased efficiency it provides. Accounting tasks that used to take hours or even days can now be completed in seconds with automated software. This includes everything from invoicing to bank reconciliation.

By automating routine tasks, businesses can free up their employees to focus on more important, value-generating activities. This can lead to higher productivity and better use of company resources.

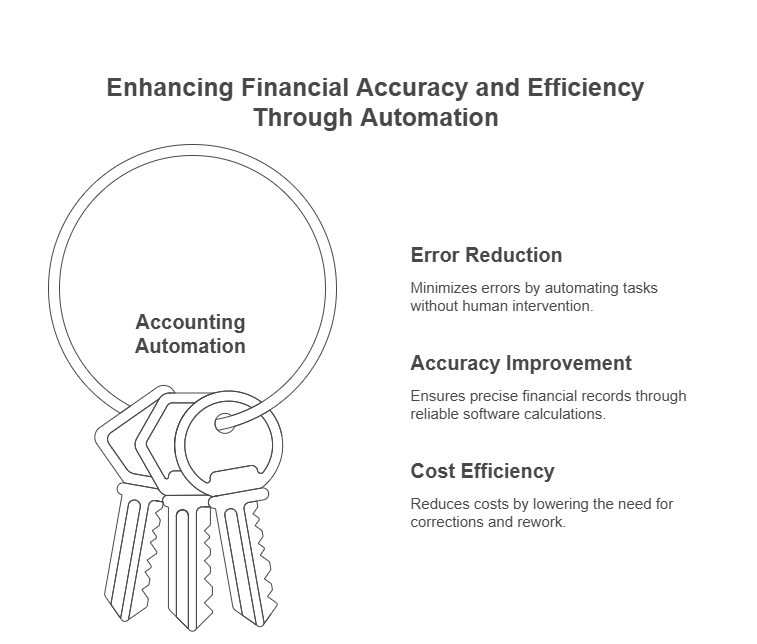

2. Reduced Human Error

Accounting automation significantly reduces the chances of error. Since the software performs tasks without human intervention, the risk of errors caused by fatigue, inattention, or lack of knowledge is minimized. This leads to more accurate financial records and reduces the need for corrections.

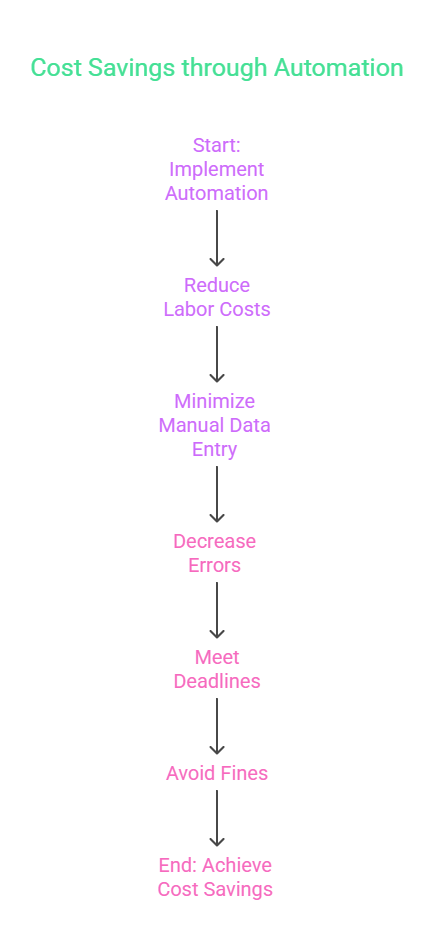

3. Cost Savings

By automating manual accounting tasks, businesses can save money on labor costs. Employees no longer need to spend hours manually entering data or performing calculations. Instead, the software does all the work, which can reduce the need for additional staff or overtime pay.

Additionally, businesses can save money by reducing the costs associated with errors and missed deadlines. Automated systems ensure that tasks are completed on time and without mistakes, reducing the risk of fines or penalties.

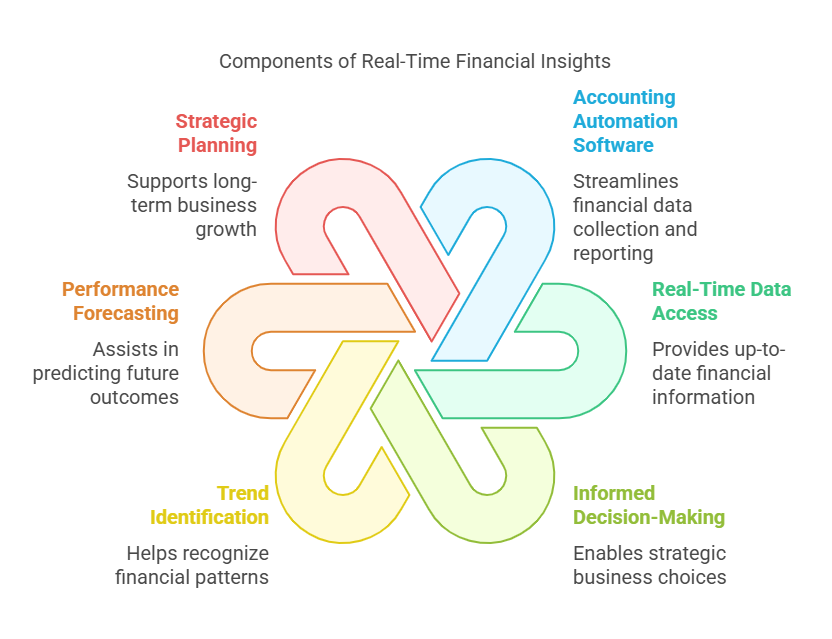

4. Real-Time Financial Insights

Accounting automation software provides real-time access to financial data, enabling businesses to make informed decisions. Managers and accountants can access up-to-date reports on cash flow, expenses, and profits, allowing them to monitor the financial health of the business at any given moment.

Real-time financial insights can also help businesses identify trends and forecast future performance. This information is crucial for making strategic decisions, managing budgets, and planning for growth.

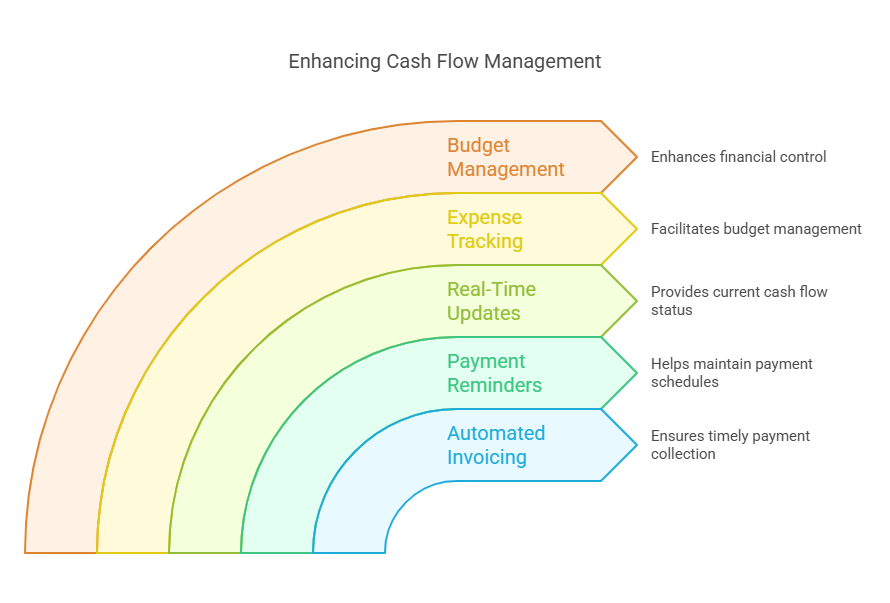

5. Improved Cash Flow Management

Cash flow is the lifeblood of any business, and accounting automation software helps businesses manage their cash flow more effectively. With automated invoicing and payment reminders, businesses can ensure that payments are collected on time.

Automated systems also provide real-time updates on cash flow, making it easier to track expenses and manage budgets. This gives businesses greater control over their finances and reduces the risk of running into cash flow problems.

6. Enhanced Security

Storing financial data on paper or in spreadsheets can be risky. Paper documents can be lost, damaged, or stolen, leading to security breaches. Spreadsheets, on the other hand, can be easily modified or deleted, compromising the integrity of financial data.

Accounting automation software provides a secure, cloud-based solution for storing financial data. Cloud storage ensures that your data is protected by encryption and other security measures, reducing the risk of unauthorized access or loss.

7. Simplified Tax Compliance

Tax compliance is a complex and time-consuming task. Manual accounting systems often require businesses to spend significant time collecting, organizing, and reporting financial data for tax purposes.

Accounting automation software simplifies this process by automatically generating tax reports and keeping track of deductions, credits, and liabilities. The software also ensures that businesses comply with tax regulations, reducing the risk of errors and penalties.

8. Better Financial Forecasting

Accurate financial forecasting is essential for business planning. However, creating forecasts manually can be time-consuming and prone to errors.

Accounting automation software provides businesses with the tools they need to create accurate financial forecasts. By analyzing past performance and considering current trends, the software can generate projections for future revenue, expenses, and profits. This helps businesses plan for growth and make better financial decisions.

9. Streamlined Reporting

Generating financial reports manually can be a tedious task. Accountants must gather data, organize it, and create reports that are accurate and up-to-date.

Accounting automation software simplifies reporting by automatically generating financial reports. These reports can be customized to meet the specific needs of the business and can be generated at any time. This makes it easier for managers and executives to monitor performance and make informed decisions.

Accounting Tasks That Can Be Automated

Accounting automation software can automate a wide range of tasks, including:

- Invoicing: Create and send invoices automatically, reducing the time spent on billing.

- Expense Management: Track and categorize expenses automatically, making it easier to manage costs.

- Payroll: Automate payroll calculations, tax deductions, and payment processing.

- Bank Reconciliation: Automatically reconcile bank statements with financial records.

- Financial Reporting: Generate accurate financial reports without manual data entry.

These tasks, when automated, reduce the time spent on manual work and allow employees to focus on more important activities.

Key Features of Accounting Automation Software

Cloud-Based Storage

Cloud-based accounting automation software allows businesses to store financial data securely in the cloud. This ensures that the data is accessible from anywhere, making it easier to collaborate with team members and access information in real time.

Integration with Other Systems

Accounting automation software can integrate with other business systems, such as payroll, inventory management, and customer relationship management (CRM) software. This allows for seamless data flow between systems and eliminates the need for manual data entry.

Mobile Access

Many accounting automation tools offer mobile apps that allow users to access financial data and perform tasks on the go. This is especially useful for business owners and managers who need to monitor their finances while traveling or working remotely.

Customizable Reporting

Accounting automation software often includes customizable reporting features that allow businesses to generate reports tailored to their specific needs. These reports can be customized by date range, expense category, and other criteria.

FAQ

1. What is accounting automation software?

Accounting automation software uses technology to automate routine accounting tasks such as invoicing, expense management, and financial reporting. This software helps businesses save time, reduce errors, and improve financial accuracy.

2. What are the key benefits of accounting automation?

The key benefits include increased efficiency, reduced human error, cost savings, real-time financial insights, better cash flow management, enhanced security, simplified tax compliance, and improved financial forecasting.

3. Can accounting automation software integrate with other systems?

Yes, many accounting automation tools integrate seamlessly with other business systems such as payroll, inventory management, and CRM software.

4. Is accounting automation software secure?

Yes, cloud-based accounting automation software provides enhanced security by encrypting financial data and protecting it from unauthorized access.

5. How does accounting automation help with tax compliance?

Accounting automation software simplifies tax compliance by automatically generating tax reports and tracking deductions, credits, and liabilities, ensuring businesses comply with tax regulations.

Conclusion

Accounting automation software is a game-changer for businesses looking to improve efficiency, reduce errors, and streamline their financial processes. By automating tasks like invoicing, expense management, and financial reporting, businesses can save time, reduce costs, and improve financial accuracy.

With its real-time insights, enhanced security, and simplified tax compliance, accounting automation software is a must-have for businesses of all sizes.