Small businesses face many challenges, from managing cash flow to staying compliant with tax laws. One of the most effective ways to reduce stress and streamline operations is by using accounting software. But not all accounting software is easy to use, especially for small business owners who may not have much experience with complex financial tools.

So, what makes accounting software user-friendly for small businesses? This article explores the key features that make accounting software simple, intuitive, and beneficial for small business owners.

1. Simple and Intuitive Interface

A user-friendly accounting software should have an interface that is easy to navigate. Small business owners often have limited time to learn complex tools. A cluttered interface with too many options can cause frustration.

Key Features of a Simple Interface:

- Clear, easy-to-read fonts and icons

- Easy-to-navigate menus and dashboards

- Simple onboarding process for new users

When accounting software is easy to navigate, it saves time and reduces the learning curve. Most small businesses do not have dedicated accounting teams, so a simple interface is critical.

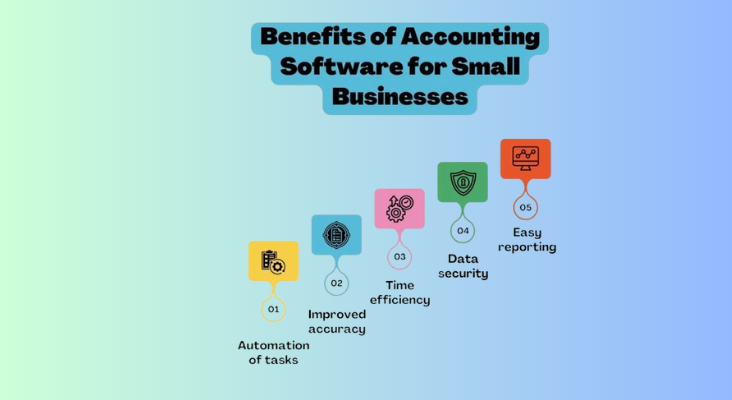

2. Automated Features

Automation is one of the best ways to make accounting software easier to use. Automating repetitive tasks like invoicing, payroll, and tax calculations reduces human error and saves time.

For example, some software can automatically generate invoices when a payment is received. Others can track expenses by linking to your bank account, eliminating the need for manual data entry.

Why Automation Matters:

- Reduces errors

- Saves time on manual tasks

- Allows small businesses to focus on growth

Automation helps small business owners focus on the things that matter most. It also helps ensure that financial records are accurate and up-to-date.

3. Cloud-Based Access

Cloud-based accounting software allows small business owners to access their financial data from anywhere with an internet connection. This is especially useful for business owners who are often on the move.

With cloud-based software, users can:

- Access their data from any device

- Share data with accountants or team members in real time

- Back up their data securely to prevent loss

Cloud access is a crucial feature for modern small businesses. It makes managing finances easier, faster, and more flexible.

4. Customizable Features

Every business is unique, so accounting software should offer some level of customization. Customizable features allow small businesses to tailor the software to their specific needs, making it more efficient.

For instance, some small businesses may need specific tax settings or custom invoices with their branding. A user-friendly software should allow these customizations without requiring technical expertise.

Customizable Features Include:

- Tax rates specific to your business location

- Customized invoice templates

- Adjustable reporting formats

Being able to customize the software ensures that the small business owner can get the reports and data that are most important to them.

5. Easy Integration with Other Tools

Small businesses often use various tools for operations, including payment processors, project management software, and payroll services. Accounting software that integrates seamlessly with other business tools makes data entry and tracking more efficient.

For example, integrating with tools like PayPal, Stripe, or QuickBooks ensures that financial data is automatically updated in the accounting system.

Why Integration is Important:

- Reduces manual data entry

- Ensures data accuracy

- Streamlines overall operations

Integration reduces the need for repetitive tasks and ensures that business data is synchronized across different platforms.

6. Real-Time Data and Reporting

Small businesses need up-to-date financial information to make timely decisions. Real-time data and reporting are essential features for any accounting software.

With real-time reporting, small business owners can:

- Track expenses and income instantly

- Get an overview of cash flow

- Monitor the financial health of the business

Having access to this data in real time ensures that business owners can make informed decisions quickly. This is especially important for managing cash flow and planning for the future.

7. Mobile Compatibility

In today’s fast-paced world, small business owners often need to manage their finances on the go. Mobile compatibility allows business owners to access accounting data from their smartphones or tablets.

This feature is important because it:

- Gives access to financial data anytime, anywhere

- Helps with on-the-go invoicing and expense tracking

- Provides easy access to reports from mobile devices

Being able to manage finances from a mobile device means that business owners can stay on top of their finances, even when they’re away from their desk.

8. Security and Data Protection

For small businesses, security is a top priority. Accounting software must have robust security measures in place to protect sensitive financial data. Features like encryption and multi-factor authentication ensure that data is safe from unauthorized access.

What Makes Accounting Software Secure:

- SSL encryption for secure data transfer

- Multi-factor authentication for logins

- Regular software updates to patch vulnerabilities

Ensuring the security of financial data is essential for small business owners who need to protect their reputation and avoid potential financial losses due to fraud or theft.

9. Affordable Pricing

Small businesses often operate on tight budgets, so affordability is key when choosing accounting software. User-friendly accounting software should offer tiered pricing to accommodate businesses of different sizes and needs.

A good pricing model provides:

- A free trial period for users to test the software

- Flexible pricing plans based on features needed

- No hidden fees or unexpected charges

Affordable pricing makes it easier for small businesses to access powerful accounting tools without breaking the bank.

10. Customer Support and Resources

No matter how user-friendly accounting software is, there will always be questions or issues that arise. That’s why great customer support is a must. User-friendly software should come with accessible support channels, such as live chat, phone support, or email.

Support resources should include:

- Step-by-step tutorials

- Video guides for common tasks

- A comprehensive FAQ section

Good customer support helps users solve problems quickly and ensures that they get the most out of their software.

FAQ

1. What is the most important feature of user-friendly accounting software?

The most important feature is an easy-to-use interface. It helps users navigate the software without confusion.

2. Is cloud-based accounting software better for small businesses?

Yes, cloud-based software offers easy access from any device and ensures data is always backed up.

3. How does automated invoicing benefit small businesses?

Automated invoicing saves time, reduces errors, and ensures that invoices are sent on time.

4. Can I customize accounting software for my business?

Most user-friendly accounting software allows customization, such as adjusting tax rates and invoice templates.

5. How secure is my data with accounting software?

Reputable accounting software uses encryption and multi-factor authentication to ensure data security.

Latest Statistics on User-Friendly Accounting Software

According to a 2023 report by Business News Daily, 62% of small business owners report that using cloud-based accounting software has improved their business operations. This includes better tracking of income, expenses, and taxes.

A survey by QuickBooks in 2022 found that 74% of small businesses that adopted accounting software saw a significant reduction in errors compared to manual accounting methods.

Conclusion

User-friendly accounting software is a valuable tool for small businesses. It simplifies the complex tasks of managing finances, reduces human error, and saves time. Features like an intuitive interface, automation, cloud access, and integration with other tools make accounting software accessible for small business owners. When selecting accounting software, focus on simplicity, affordability, and the ability to grow with your business. This will ensure that you’re making the most of your accounting tool.